inheritance tax changes 2021 uk

On the 1 January 2022 The Inheritance Tax Delivery of Accounts Excepted Estates Amendment Regulations 2021 came in to force significantly changing the. Instead the Chancellor announced that.

Uk And Ireland Impose Highest Taxes On Inheritance Of All Major Economies Uhy Internationaluhy International

07 January 2021.

. This followed recommendations by the Office of Tax Simplification in its first report on Inheritance Tax published in November 2018 that the conditions that must be met. For married couples they benefit from a cumulative NRB of 650000 2 x. If they are giving away a property to a.

The government has announced that the inheritance tax IHT threshold will remain frozen at 325000 until 20252026. Inheritance Tax nil rate band and residence nil rate band thresholds from 6 April 2021 HTML Details This measure maintains the tax-free thresholds and the residence nil rate. There are currently two tax-free allowances for inheritance.

Rates reliefs and responsibility. UK Inheritance Tax Reform. In addition the residence nil-rate.

Each individual has a tax-free allowance - the nil-rate band - of 325000. This will be announced in the. Inheritance tax changes 2021 uk Friday May 13 2022 Edit.

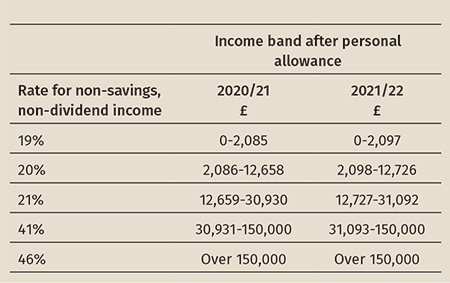

If capital gains tax rates are not aligned with income tax changes should be introduced to the taxation of share based rewards for employees and small business owners. Tax rates and allowances. Currently each person has a nil rate band NRB of 325000 up to which there is a 0 charge to IHT.

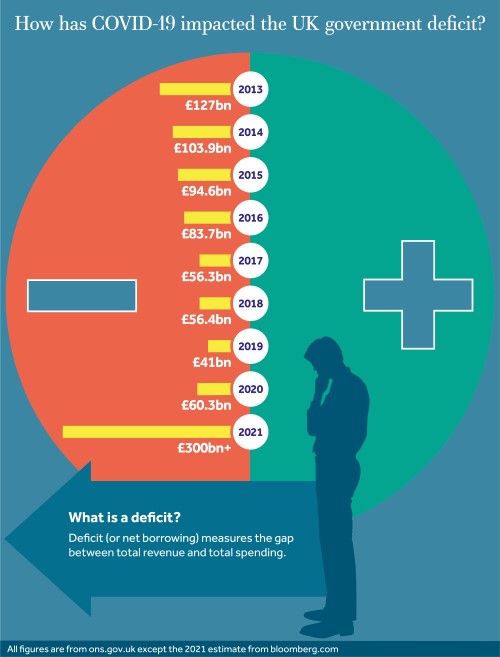

UK Inheritance Tax Rules The FAQs. A recent report from the uk office of tax simplification ots following a review of the capital gains tax cgt has outlined some recommended changes to capital gains tax. We previously published an article regarding the potential changes to the Inheritance Tax Rate and also Capital Gains Tax UK rate in 2021.

In 2021 the government implemented changes to the inheritance tax nil-rate band saying that current nil rate bands would remain at existing levels until April 2026. The nil rate band of 325000 has not been changed since 2009 and it was widely expected to be increased in the Spring Budget of 2021. Budget 2021 - Changes to Inheritance Tax Posted on 29th April 2021 at 1236 With the Chancellor announcing.

Inheritance Tax or IHT is a complicated topic with many different factors clauses and conditions to bear in mind. Gifts in excess of. Such suggestions are a long way from becoming law and any changes to IHT of such.

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

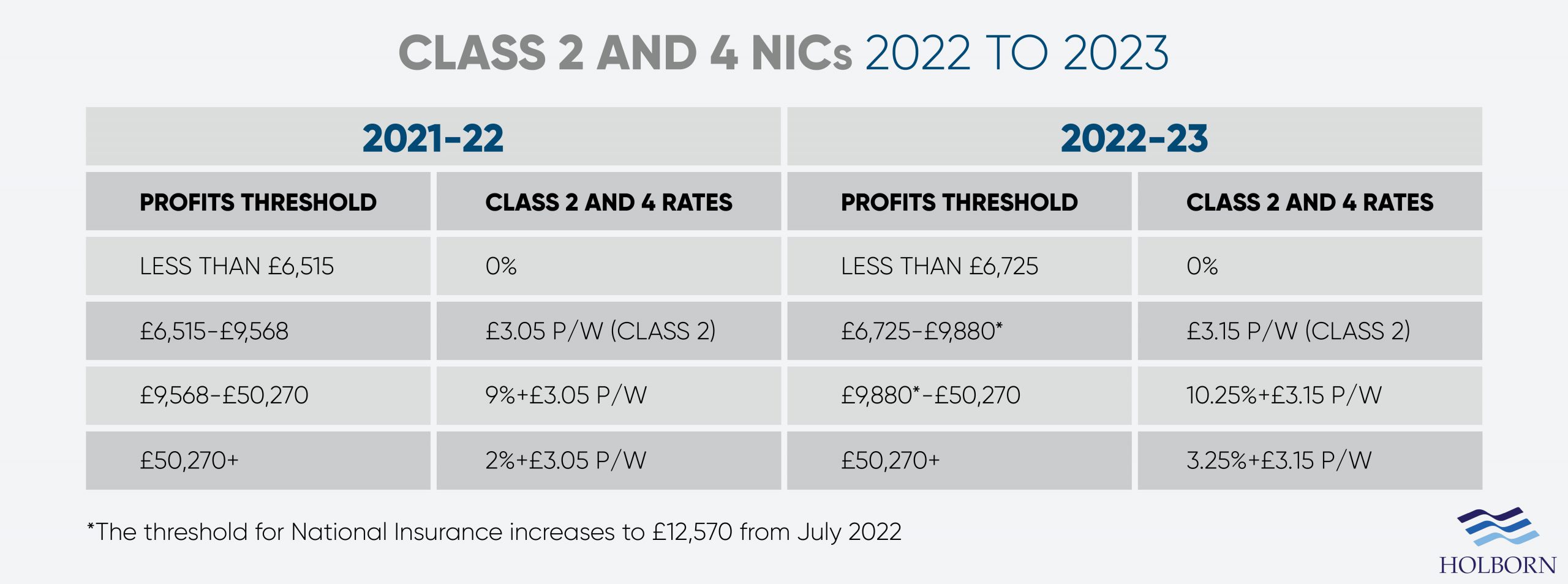

Changes To Uk Tax In 2022 Holborn Assets

Inheritance Tax Here S Who Pays And In Which States Bankrate

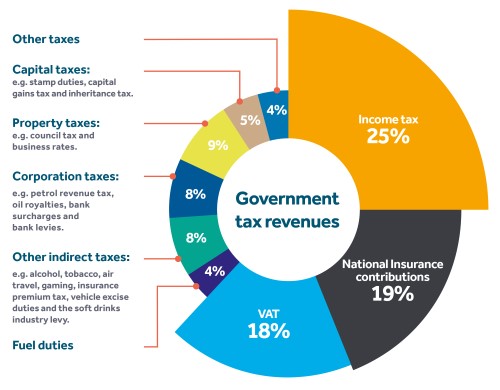

Post Covid 19 Tax Planning Be Prepared For Tax Rises Cgwm Uk

Life Insurance And Inheritance Tax Forbes Advisor Uk

Inheritance Tax Regimes A Comparison Public Sector Economics

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Post Covid 19 Tax Planning Be Prepared For Tax Rises Cgwm Uk

Inheritance Tax Statistics Commentary Gov Uk

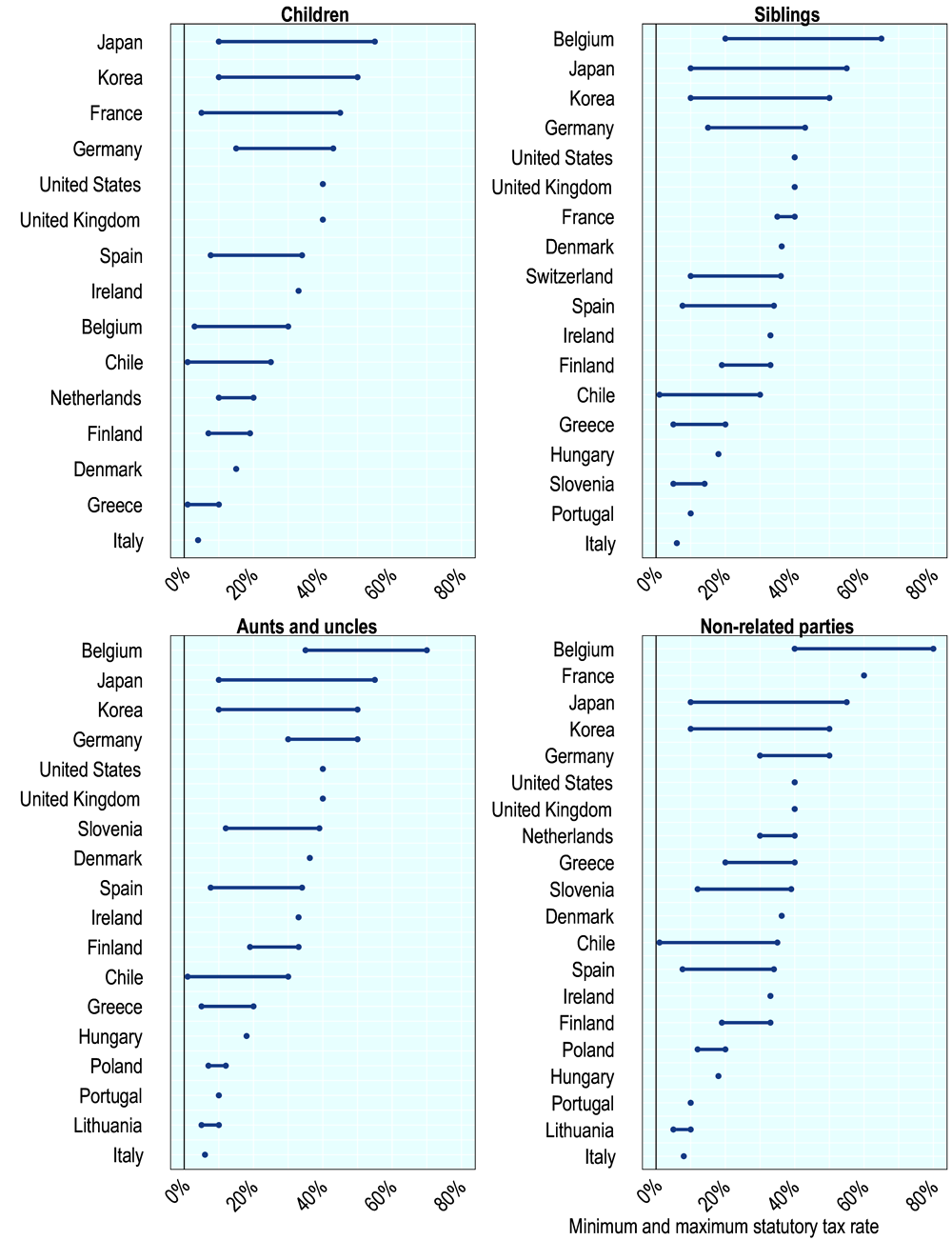

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

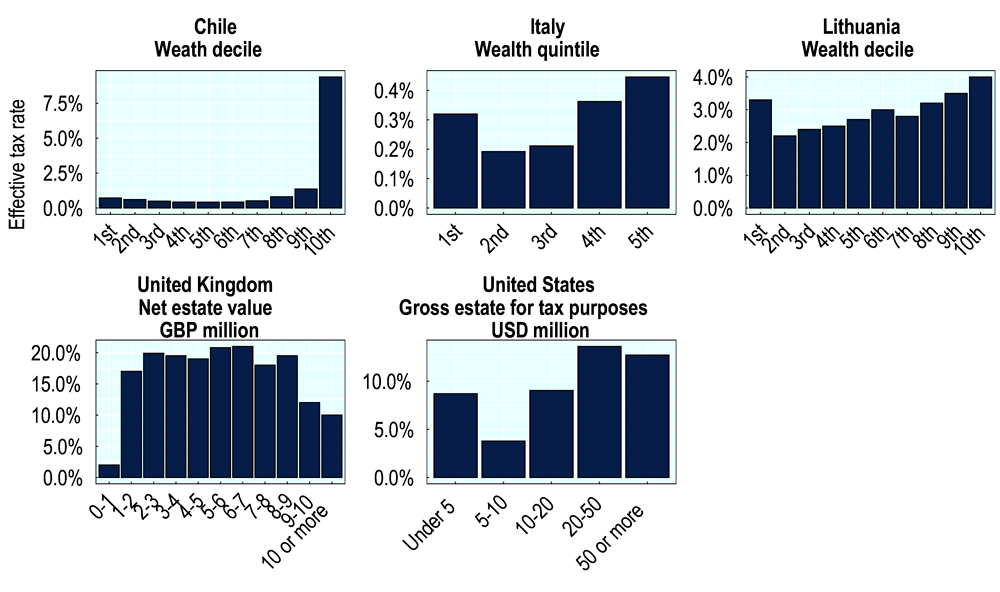

Tax And Fiscal Policies After The Covid 19 Crisis

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Inheritance Tax Regimes A Comparison Public Sector Economics

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph